France remains one of the most attractive destinations for international expansion. For the sixth year in a row in 2024, France was the number one destination for foreign investors in Europe and the 7th globally in 2023.

For foreign companies considering establishing a subsidiary company in France, understanding the process is critical. This guide provides expert insights into the steps, legal structures, and benefits associated with setting up a subsidiary in France, ensuring a smooth entry into the French market.

Benefits of Opening a Subsidiary in France

.webp?width=1914&height=1077&name=France%20-%20Employer%20of%20Record%20France%20Guide%20(anthony%20delanoix).webp)

Doing Business in France

France offers a compelling blend of market access, innovation incentives, and a stable business environment. The most attractive French business sectors for investment are manufacturing, real estate, and financial and insurance services. France has also become a leader in attracting investment in strategic, high-tech areas like artificial intelligence, quantum research, and low-carbon energy.

For foreign companies, understanding how to do business in France is key to success. With its strategic location and robust economy, France represents a gateway to the European Union. Setting up a subsidiary in France can provide access to these advantages.

How establishing a subsidiary in France helps you win market shares

For those eager to expand your business, establishing a subsidiary in France delivers several strategic benefits. It may even pave the way to your success in France. The French market provides direct access to the European Union’s single market of over 440 million consumers. With over 67 million residents, France offers many opportunities. This location in Western Europe provides logistical advantages.

Having a local presence is of tremendous help to entering the French market more extensively. French people are more easily buying from other local French businesses, and to people they can speak French to. To develop your activities in France, it will be easier for you to have a local person. In fact, only 15% of French people say they speak the language well, and 4% reported excellent English skills.

Understanding Subsidiaries in France

Definition of a Subsidiary

A subsidiary is a separate legal entity incorporated under French law, operating independently from the parent company. As an independent business entity, even if it is wholly or majority-owned by a foreign parent company, a subsidiary company holds its assets, enters contracts in its business name, and bears its legal responsibilities.

Differences Between a Subsidiary and a Branch in France

It’s vital to understand the differences between a branch and a subsidiary. A branch and its parent company share a legal identity, also sharing risks. Subsidiaries have more freedom and can adjust better to local needs, making them more flexible than setting up a branch. Branches may lead to higher taxation compared to a subsidiary.

| Branch | Subsidiary | |

| Liability | Not a separate entity from the parent company. The parent company is liable. | Limited (subsidiary level). |

| Representative Nationality | Need to appoint a branch representative in France. Not required to be a French national. | Not required for directors to be French nationals. Residence/work permits must be in order. |

| Registration costs | ~500€ | ~500€ |

| Sales Contracts & Profits | Parent company level | Subsidiary level |

| Timeline | Within 2 weeks | Within 2 weeks |

There are additional distinctions regarding the accountings, the taxes (double tax treaties, VAT processes), the operation costs (a bit higher for a subsidiary), and the required mandatory filings with authorities to consider once one of the two solutions is chosen.

Types of Subsidiaries in France

France offers several types of company structures for French subsidiaries.

- The Simplified Joint Stock Company (SAS) is favored for its adaptability.

- The Private Limited Liability Company (SARL) is ideal for SMEs.

- The Joint-Stock Company (SA) is for larger corporations needing capital.

- The Single-Member Simplified Joint Stock Company (SASU) is suitable for wholly owned expansions.

Now let's focus on this particular point in our next chapter to understand which structure to choose for your new company in France.

Legal Structure for Subsidiaries

Creating a Subsidiary: the Right Legal Structure

Selecting the appropriate legal structure impacts governance, financing options, and operational agility. This choice affects how we operate, considering how much money we have. When starting a business, it’s key to understand how the type impacts our success. It’s smart to look at our business goals first for selecting the right legal structure.

As a foreign company entering the French market, it will be crucial to sit down with an expert and discuss all the implications of your future operations in France:

- Business objectives and business needs

- Sales processes

- Long-term business strategy: Will you sell the subsidiary or welcome investors?

- Liability of the products or services in France

- Distribution of profits and dividends

- Price transfer strategy

- Shareholder structure of the French entity

- Etc.

Remember: for a business expansion in a new country, careful planning is as important as perfect execution.

Understanding the Basics of Business Structure in France

When setting up shop in France, knowing the main business structure is key. We often come across branches and subsidiaries. A branch acts like a part of the parent company, not a separate thing.

On the other hand, a subsidiary stands on its own legally, offering more freedom in operations. Subsidiaries are appealing for those wanting security.

Let's dive into the four main business structures you can register with the French authorities.

| Simplified Joint Stock Company (SAS) | Private Limited Liability Company (SARL) | Joint-Stock Company (SA) |

Single-Member Simplified Joint Stock Company (SASU)

|

|

| Number of Shareholders | Minimum of 1 (no maximum) | 2 to 100 | Minimum of 2 for a non-listed company, and 7 for a listed company | 1 |

| Capital Minimum | No minimum (can be €1) | No minimum (can be €1) | €37,000 for non-listed companies; €225,000 for listed companies |

No minimum (can be €1)

|

| Management Structure | Highly flexible. Can have a President (required), and optionally a CEO, board of directors, or supervisory board. | Managed by one or more managers (gérants). | Managed by a board of directors with a Chairman and a CEO, or by a directorate with a supervisory board. |

Managed by a President (required).

|

| Easiness to Run / Flexibility | Very flexible. Statutes can be freely drafted. Ideal for new ventures and partnerships. | More rigid. Statutes are highly regulated by law. | Highly regulated and more complex. Best suited for large businesses. |

Very flexible, similar to the SAS. Ideal for a single founder.

|

| Tax Obligations | Corporate tax (IS). Option for an income tax regime for 5 years if the company is less than 5 years old. | Corporate tax (IS). Possibility to opt for an income tax regime for 5 years. | Corporate tax (IS). |

Corporate tax (IS). The sole shareholder can choose the income tax regime without a time limit.

|

| Official Obligations | Fewer formalities. No need for a board of directors unless the statutes require it. Decisions are made according to the statutes. | Strict legal framework for decision-making and meetings. | Strict rules regarding general meetings, board meetings, and official publications. |

Simplified obligations, similar to the SAS.

|

| Filing Obligations | Annual approval of accounts, filings with the commercial court. | Annual approval of accounts, filings with the commercial court. | Strict filing obligations, including annual accounts, general meeting minutes, and financial reports. |

Annual approval of accounts, filings with the commercial court.

|

| Fees for Creation | Varies. Usually between €200 and €400 (plus potential legal fees). | Varies. Usually between €200 and €400 (plus potential legal fees). | Higher. Varies based on capital and complexity. (plus legal fees). |

Varies. Usually between €200 and €400 (plus potential legal fees).

|

| Timeline for Creation | Generally 1 to 2 weeks. | Generally 1 to 2 weeks. | Can be longer due to stricter formalities. |

Generally 1 to 2 weeks.

|

Registration Process for a French Company

Starting the registration process to set up your subsidiary in France needs careful planning. Understanding the steps clearly helps follow them correctly. Knowing the French company formation requirements for a subsidiary helps in starting the registration process. Company registration is an important step to establish a subsidiary in France.

French company formation requirements for a subsidiary in 2025

As of January 1, 2025, all company registration in France, including French subsidiary formations, must be processed exclusively through the Guichet Unique system. The Guichet Unique system, operated by the National Institute of Industrial Property (INPI), replaces the older multi-agency procedures.

Applicants can monitor the status of their filing digitally, improving transparency. All documents must be submitted in French or accompanied by certified translations. The Guichet Unique simplifies opening a subsidiary in France.

You now have one single online platform to register your company, handling all aspects of your business (registration, social security, taxes, etc.). The process is simple: register an account, complete the M0 Form, submit your info, and receive all your registration numbers.

The Process of Opening a Subsidiary in France

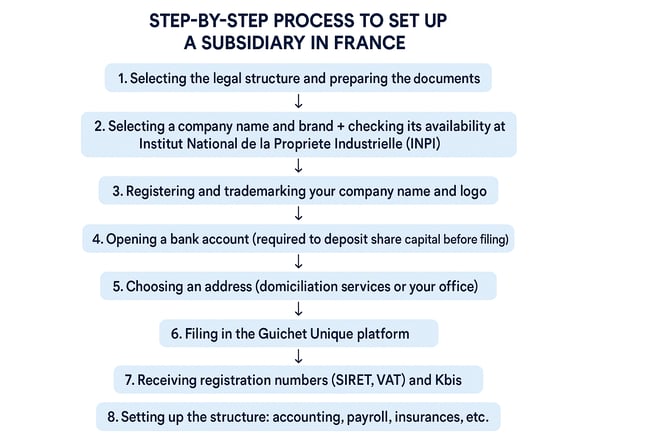

Step-by-Step Guide to Setting Up

Starting the registration process to set up your subsidiary in France needs careful planning. Understanding the steps clearly helps you follow them correctly. To file successfully through the Guichet Unique platform, several documents are required.

These include the Articles of Association, the Minutes of the Constitutive Meeting, and proof of the registered address. For the establishment of a subsidiary in France, providing proof of Capital Deposit Certificate, identification for directors and shareholders, affidavits and proof of publication is necessary. All these ensure the subsidiary operates as a legal entity.

Here is the step-by-step process to set up a subsidiary in France:

- Selecting the legal structure and preparing the documents

- Selecting a company name and brand + checking its availability at Institut National de la Propriete Industrielle (INPI)

- Registering and trademarking your company name and logo

- Opening a bank account (required to deposit share capital before filing)

- Choosing an address (domiciliation services or your office)

- Filing in the Guichet Unique platform

- Receiving registration numbers (SIRET, VAT) and KBIS

- Setting up the structure: accounting, payroll, insurances, etc.

Timeline for Establishing a Subsidiary

Establishing a subsidiary in France involves several steps. A well-prepared setup can typically be completed in 3 to 6 weeks. However, delays are common if key administrative steps are underestimated.

You can plan between 5 and 15 days for each of the following steps:

- Studying and preparing the incorporation form

- Opening the bank account

- Filing in the Guichet Unique platform

- Review by the authorities

- Set up the structure once approval was received

Taxation and Financial Considerations

Tax Obligations for Subsidiaries in France

Operating a subsidiary in France requires full compliance with local French tax laws and financial reporting standards. You really want to ensure you play by the book with French tax authorities. When you set up a subsidiary in France, French tax and the related obligations have to be taken into consideration.

Here's a summary of some common taxes:

| Tax Type | Rate |

|---|---|

| Corporate Income Tax | 25% |

| VAT (TVA) | 20% (Standard) |

| Dividend Withholding Tax | Typically 25% |

Other relevant taxes include Local Economic Contribution (CET) based on added value and real estate use.

How to Open a Business Bank Account for a Subsidiary in France?

Opening a business bank account is crucial for a subsidiary company in France. The exact documentation may vary among banks.

When forming a capital company like an SAS or SARL, a preliminary bank account (known as a compte de dépôt de capital) must be opened to deposit the company's share capital. The bank will then issue a "certificate of capital deposit" (attestation de dépôt de capital), which is essential for the final registration of the company. Once the company is officially registered and has its Kbis, the funds are released into the definitive operational business account.

Then, generally, French banks ask for:

- Statutes (Articles of Association),

- Kbis: The company's official registration certificate & Tax identification number,

- Official Address Proof,

- Beneficial Owner Declaration,

- Proof of identity for company representatives,

- Business plan,

- And financial projections are also part of the documentation.

Ensure you have these documents ready to facilitate the opening of a subsidiary in France.

Benefits of Setting Up a Subsidiary

France offers tax advantages to new French subsidiaries. The labor cost in France is comparatively lower than that of a few other European nations. There is no requirement for minimum share capital, except for a setup of a joint-stock company.

Furthermore, there is asset protection, with personal assets not linked to company assets. These advantages make France appealing to foreign companies wanting to set up a subsidiary.

Financial Support and Incentives for Foreign Companies

When considering the establishment of a subsidiary in France, it’s essential to be aware of the various incentives and subsidies available. The French government offers R&D tax credits to encourage innovation, as well as the CICE, which provides a tax credit to eligible companies.

Regional authorities in France provide funding and support for innovative projects. Regional Investment Funds aim to attract and support investment projects. These initiatives can significantly benefit foreign subsidiaries in France.

Business Support and Resources

Available Business Support Services

The French government supports entrepreneurship with different programs. France offers local business support for foreign companies. These services are designed to help entrepreneurs and business owners achieve their goals, with guidance and resources to help navigate the challenges of starting and growing a company.

Setting up a subsidiary in France is not easy; having access to these support services will bring value to you.

Networking Opportunities in the French Market

We also gain a lot from joining local business networks in France, such as industry associations. These networks let us meet other entrepreneurs, share ideas, and get advice.

Joining local business networks when you establish a subsidiary in France is a practical option. It's a great way to build relationships. It will help the company grow and be successful.

Contact Points for Foreign Companies

We need to know who to contact when setting up a subsidiary in France. There are contact points that offer help to foreign companies. Also, France offers resources to help you through the setup process of a subsidiary company. The support is there to help businesses grow.

Conclusion

Your Presence in France: Recap of the Subsidiary Setup Process

In 2025, the process to set up a subsidiary in France has become increasingly streamlined, thanks to digital reforms like the Guichet Unique. The duration to establish a subsidiary depends significantly on the quality of preparation and the readiness of documentation.

Effective coordination with local partners in France is crucial for foreign companies. This will ease the entire process of establishing a subsidiary company in France and ensure compliance with all the legal regulations for limited liability companies.

Final Thoughts on Expanding into France

France remains a strategic entry point for international companies. It provides stable and scalable access to the European market. France offers unique advantages for foreign companies that want to set up a subsidiary company.

The attractiveness of the French market lies in its robust economy, skilled workforce, and strategic location. France remains a great place to establish a subsidiary.

Encouragement for Foreign Investment in France

France values foreign investors and ensures that subsidiary businesses in France do not bear the burden of double taxation. France is open to foreign businesses; its share of foreign investments in Europe was 19% in 2024.

With a supportive government committed to attracting foreign direct investment, France offers financial incentives and tax benefits for foreign companies.

FAQ

How to open a subsidiary in France?

Here is the step-by-step process to set up a subsidiary in France:

- Selecting the legal structure and preparing the documents

- Selecting a company name and brand + checking its availability at Institut National de la Propriete Industrielle (INPI)

- Registering and trademarking your company name and logo

- Opening a bank account (required to deposit share capital before filing)

- Choosing an address (domiciliation services or your office)

- Filing in the Guichet Unique platform

- Receiving registration numbers (SIRET, VAT) and KBIS

- Setting up the structure: accounting, payroll, insurances, etc.

Can a foreigner set up a company in France?

Yes, the French government encourages foreign investment, allowing foreign companies to set up subsidiaries in France. The legal structure is a SAS, SA or SARL; there are options for any company size.

The specific process and documents needed would depend on the immigration regulations and requirements applicable to the representative’s nationality. A legal advisor that is used to working with foreign subsidiaries may be useful here.

Are there any accounting rules for a French Subsidiary?

Establishing your subsidiary means you must adhere to specific accounting rules to maintain compliance and ensure accurate financial reporting. As a trusted, experienced partner, we emphasize that French subsidiaries must comply with the Plan Comptable Général (PCG), the national accounting standard.

This comprehensive framework governs accounting practices, financial statement presentation, and valuation methods. Understanding and adhering to the PCG is crucial for all French subsidiaries to meet regulatory obligations and maintain financial transparency. The accounting standards are also important for filing French tax.

Can a subsidiary own real estate in France?

Yes, a subsidiary company in France can indeed own real estate. A key advantage of establishing a subsidiary is its status as a separate legal entity, distinct from the parent company.

This legal entity empowers the French subsidiary to enter into contracts, own assets, and assume liabilities independently. Owning property directly enhances its operational capabilities.

Can the subsidiary be registered remotely?

Yes, setting up a subsidiary company in France can be registered remotely, especially with the digital advancements facilitated by the new online Guichet Unique system. Foreign companies can initiate and complete much of the registration process online.

However, some steps may require local representation or presence, such as opening a bank account or securing a registered office address. Moreover, in some cases, you will need to appoint a local representative to the company.

Do You Need a Physical Address for a Subsidiary in France?

Yes, you absolutely need a physical address for a subsidiary company in France or at least a domiciliation in a business center. Each legal structure has specific governance obligations.

Having a physical address is essential for official correspondence, legal compliance, and general business operations. Without one, company registration is not possible, and any correspondence sent won’t be received.

How does France's labor law impact how to start a parent company with local employees?

France’s labor law significantly impacts how foreign companies establish a parent company with local employees. The requirement to have employee delegates, also known as “Instances Représentatives du Personnel” (IRP), is an important aspect of labor law. These bodies serve as the voice of the employees and must be consulted on various business decisions.

How much does it cost to set up a subsidiary?

The costs of establishing a subsidiary company in France can vary widely. These costs depend on various factors such as complexity, share capital, and professional fees. For the pure setup costs, including legal fees, it may vary from over 3000 € for an SARL to several thousand for an SA or SAS.

Disclaimer: This article can't replace the legal advice of tax and legal advisors to ensure that your invoices comply with the country's regulations. We are not specialists in this matter; therefore, we cannot be sued for wrongful information or harm. Please check with experts and local authorities for up-to-date information.